Guide to Success in China: Skincare Brand

This is a series from our weekly newsletter in which we send out original content covering trends, social campaigns and advice on how to grow your brand in China. This series, GUIDE TO SUCCESS covers the audience, channels, and strategy for an imaginary brand entering the China market. We hope this gives you a starting point to better understand the type of information you'll need to know about your customer and how to use the right channels to reach them. Get this sent directly to your inbox instead of having to visit our website next time.

THE BRAND

Skincare brand using natural ingredients to power innovative formulas

THE TARGET AUDIENCE

Women

Age 34-45

Living in Tier 1, Tier 2 cities in China

IMPORTANT INFORMATION ABOUT THE TARGET AUDIENCE

The top user demand of 35-45 year-old women living in China’s urban cities will be anti-aging. This includes the desire to reduce wrinkles and dark spots, as well as benefits such as firming, moisturizing and evening out skin tone to (re)establish a healthy skin barrier.

These skincare aficionados have experience using various products and are quite knowledgable about skincare ingredients and product application. Therefore, a brand’s way of communication, general word-of-mouth and authority of the sales channel will significantly impact consumers' purchasing decisions.

CHANNELS

Leverage WeChat for the following:

Content Creation: production introduction, ingredients education, brand news

Community Building: brand membership registration & online sale through WeChat ecommerce mini program

Before & After-sale Service: Store maps, product authentic identification, etc.

Xiaohongshu (Little Red Book, RED)

Use RED to create content focusing on brand news & campaigns, influencer seeding, community building, FAQs on product efficacy and application. In addition RED can be used as an ecommerce sales channel.

Ecommerce

Your target audience will most likely be discovering your brand through product recommendations and word-of-mouth reviews on other social commerce platforms (such as RED) rather than coming first to brand-owned ecommerce channels

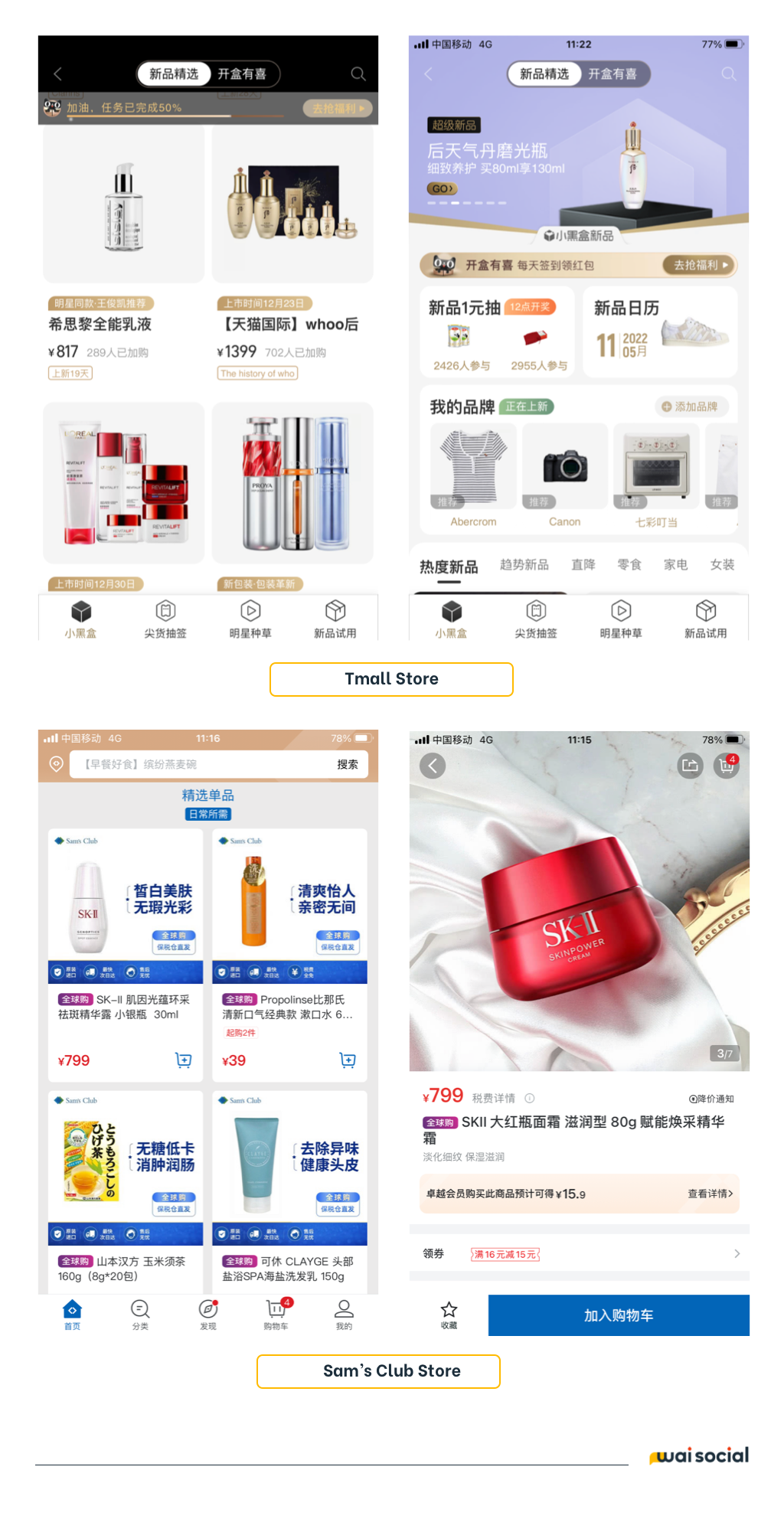

Consider ecommerce platforms such as Tmall and Sam’s Club which typically attract more affluent Chinese consumers

Keep in mind ecommerce is not only an opportunity for sales, but can be another efficient way to expand awareness

INFLUENCER STRATEGY

Leverage the Diamond-shaped Seeding Method on RED: 70 percent of your influencer budget will go towards medium level KOLs (Key Opinion Leaders) who have between 10K-100K followers. Around 20 percent should be allocated towards collaborations with KOC (Key Opinion Customers) who have less than 10K followers and the rest is allocated towards high-level KOL or celebrities with more than 100K followers.

First, consider working with KOLs who are known for detailed analysis of ingredients and efficacy (this could even be a nutritionist) to introduce your products. In addition, influencers over the age of 35 who live in first- and second-tier cities, with affluent lifestyles can also be very persuasive.

*Read more from us about influencer seeding on RED here

OTHER IMPORTANT THINGS TO KEEP IN MIND

1. Awareness of cosmetics safety is not as popular in China as it is in the West, but the messaging for China can be adjusted to “avoid sensitivity and further damage” or “purify and nourish skin foundation”

2. Watch out for what the big brands are doing in China and leverage popular/star ingredient trends such as Peptides, Retinol, and the new rise of Pro-Xylane

3. Pay attention to pregnant women in this age range who may be experiencing sensitive skin and safety concerns, as well as consumers who are keen on environmental protection or minimalism

4. If your product is very effective and you are confident that it can easily beat the competition in the market, then congratulations! This is a shortcut to building brand awareness. If there is no breakthrough in this area for the time being, it is recommended to promote an overall concept that can easily win the favor of consumers from the perspective of a type of lifestyle

5. Before launching on social channels it is best to start with an ecommerce platform, which will help open up many verification opportunities on Chinese social media

6. Brands with relatively weak supply chains need to carefully consider their business plans. Especially due to the current situation in China, this can be a big challenge for any start-up or even established brand