Chinese Brand to Know: Chi Forest 元气森林

This is a series from our weekly newsletter in which we introduce a Chinese brand you need to know. Because 1) there are some seriously cool Chinese brands out there doing some great marketing and 2) we believe it can help you better localize your own marketing in China. Get the newsletter sent directly to your inbox instead of having to visit our website next time.

BRAND NAME

Chi Forest 元气森林

CATEGORY

Beverage brand, founded in 2016. Tagline; “0 calories, 0 fat and 0 sugar”

Drinks include fruit-tasting sparkling water and tea, infused with functional benefits

PRICE POINT

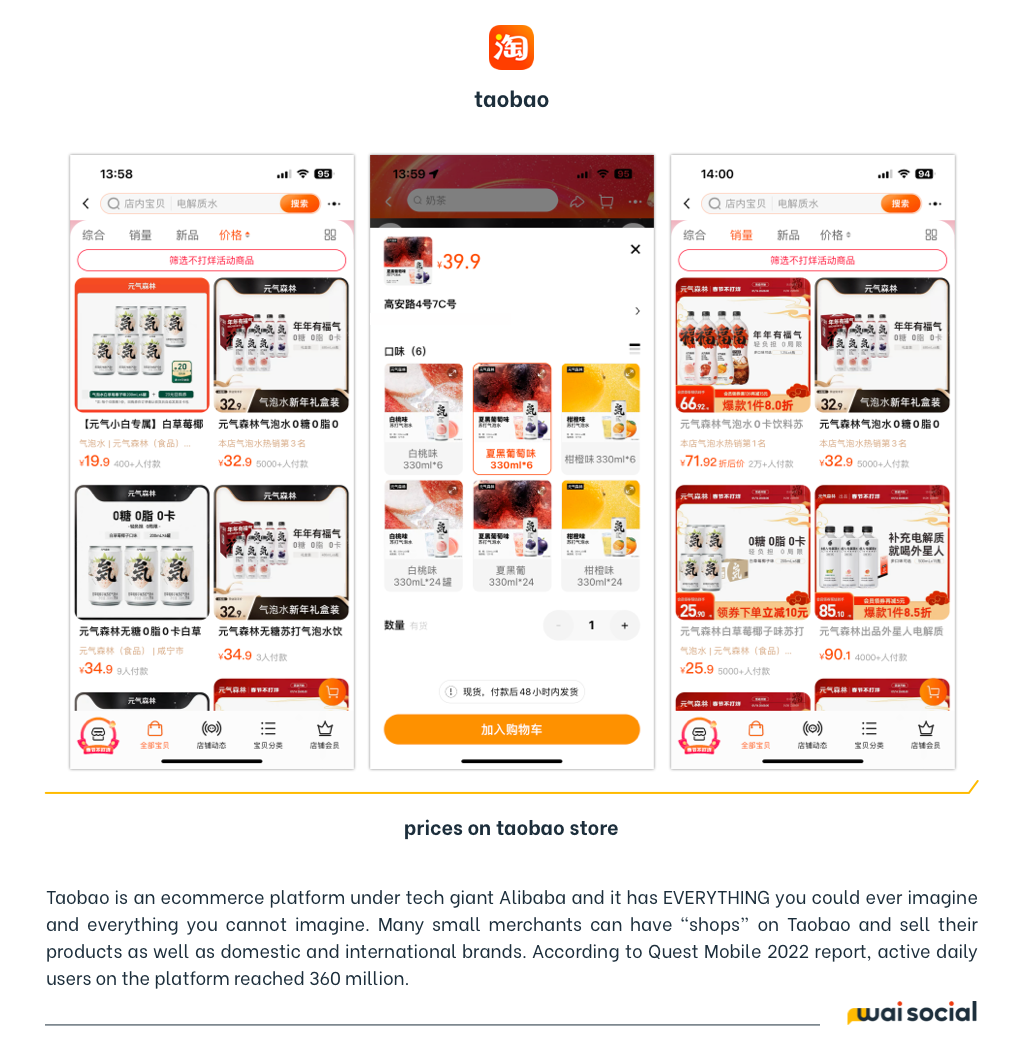

'0 sugar 0 calorie' electrolyte water - $.80/500ml

'0 calorie' sparkling water - $1.70/1.25L

Low-sugar, low-fat milk tea - $1.70/450ml

'0 sugar' lemon tea - $.80/450ml

'0 sugar' herbal tea - $.95/500ml

100% fruit juice bubble drink - $1.20/380ml

NFC fruit and vegetable juice - $1.20/280ml

Mineral water - $.50/568ml

TARGET AUDIENCE

Young consumers in 1st-2nd tier cities from students to white-collar workers.

Packaging design is more skewed towards female consumers who care about fitness and wellness.

WHAT THE BRAND DOES WELL

1. Localizing within a relatively low-competition category

According to CICC’s estimates, the penetration rate of sugar-free tea drinks in the Japanese market has already reached more than 80% in 2019, while the proportion of sugar-free tea in the Chinese market was only 5.2%. Similarly, sugar-free sparkling water products led by Coke have been selling well in Western markets for many years, while this trend of diet consumption or "light meal” (轻食) in China only began to rise around 2017. Chi Forest is banking on a wave of rising popularity and have created products more localized for China.

*CICC refers to China International Capital Corporation Limited

2. Focus on one clever/catchy concept to build recognition and trust

All of Chi Forest's current products revolve around “0 sugar, 0 fat and 0 calories”. While these ‘benefits’ may already exist in other beverage products, such as water, sugar-free tea, Diet Coke, etc. they haven't been highlighted in this way yet. This is the simple but efficient secret of Chi Forest's success. Under the brand positioning of "sugar-free experts”, all product tonality fits within this concept. This consistency is also conducive to helping Chi Forest focus on the entire category of sugar-free beverages.

3. Data-driven new product testing

Chi Forest has an “inventory” reserve of hundreds of SKUs every year, which they are constantly testing. Once verified, a product can be put into large-scale production and promotion at incredible speed.

Different from the common test method FGD (Focus Group Discussion) in the traditional beverage industry, Chi Forest is led by a team with an entrepreneurial/gaming industry background who dare to adapt the R&D process of digital products to F&B.

4. Having the guts to challenge old giants in the industry

In 2022, Chi Forest launched Coca-flavored sugar-free sparkling water, officially revealing its ambition to become the "Chinese version of Coca-Cola” and a global beverage giant. This step has actually begun to eat into the market share of Diet Coke, in part due to how easily consumers can resonate with the logic behind the product — sugar-free sparkling water = sugar-free cola. The announcement article on their official WeChat has achieved over 58k reads and tons of interactions - obviously welcomed by domestic young consumers.

WHAT CAN OTHER BRANDS LEARN?

1. Even if it is a leader among new consumption brands, Chi Forest has always clarified the core concept of "product is king” as shown through the brand's investment in ingredients, the full use of big data, and comprehensive and in-depth consumer insights.

2. Give decision-making power to young people. The team members of Chi Forest are very young, and the product managers are usually only in their twenties. This makes it easier for them to understand the preferences of Gen Z in China. As long as the team members generally love the products, they are bound to be welcomed by the target consumers.

3. Know how to avoid risks. Although it draws on the experience of brands in Japan and the West for many research and development ideas, Chi Forest has always made a clear effort to distance itself from foreign influence. Of course, in part to defend and strengthen the original domestic brand image, and also to avoid the risks that politically sensitive words like "Japan" may bring in the Chinese market.

4. Diversified advertising. Chi Forest not only invites popular celebrities to endorse products, but also puts ads on a large number of variety shows that young people like to watch, and disseminates brand info all over high-rise elevators and subways in first- and second-tier cities to leverage large-scale, multi-frequency touchpoints of the target consumer group.

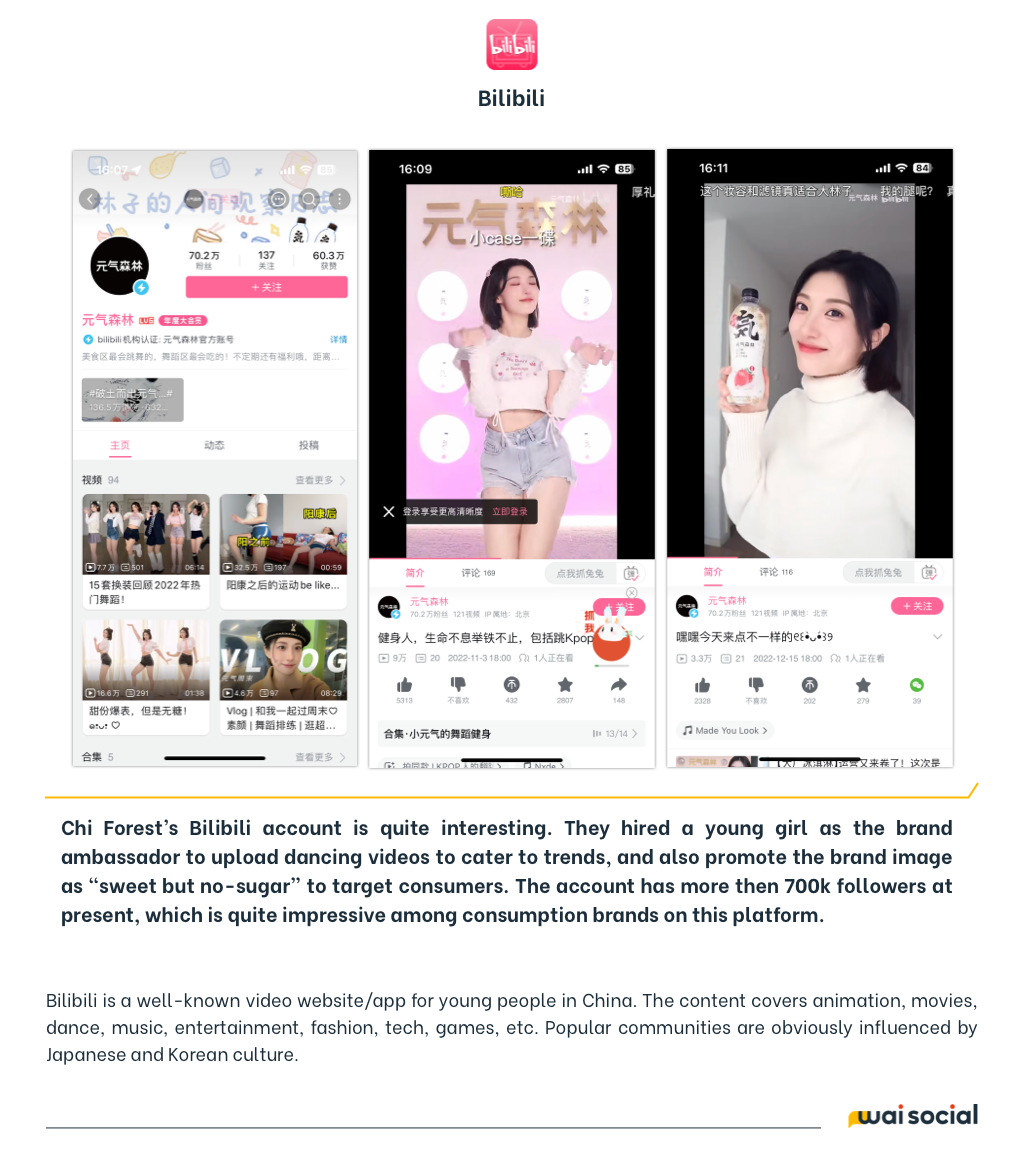

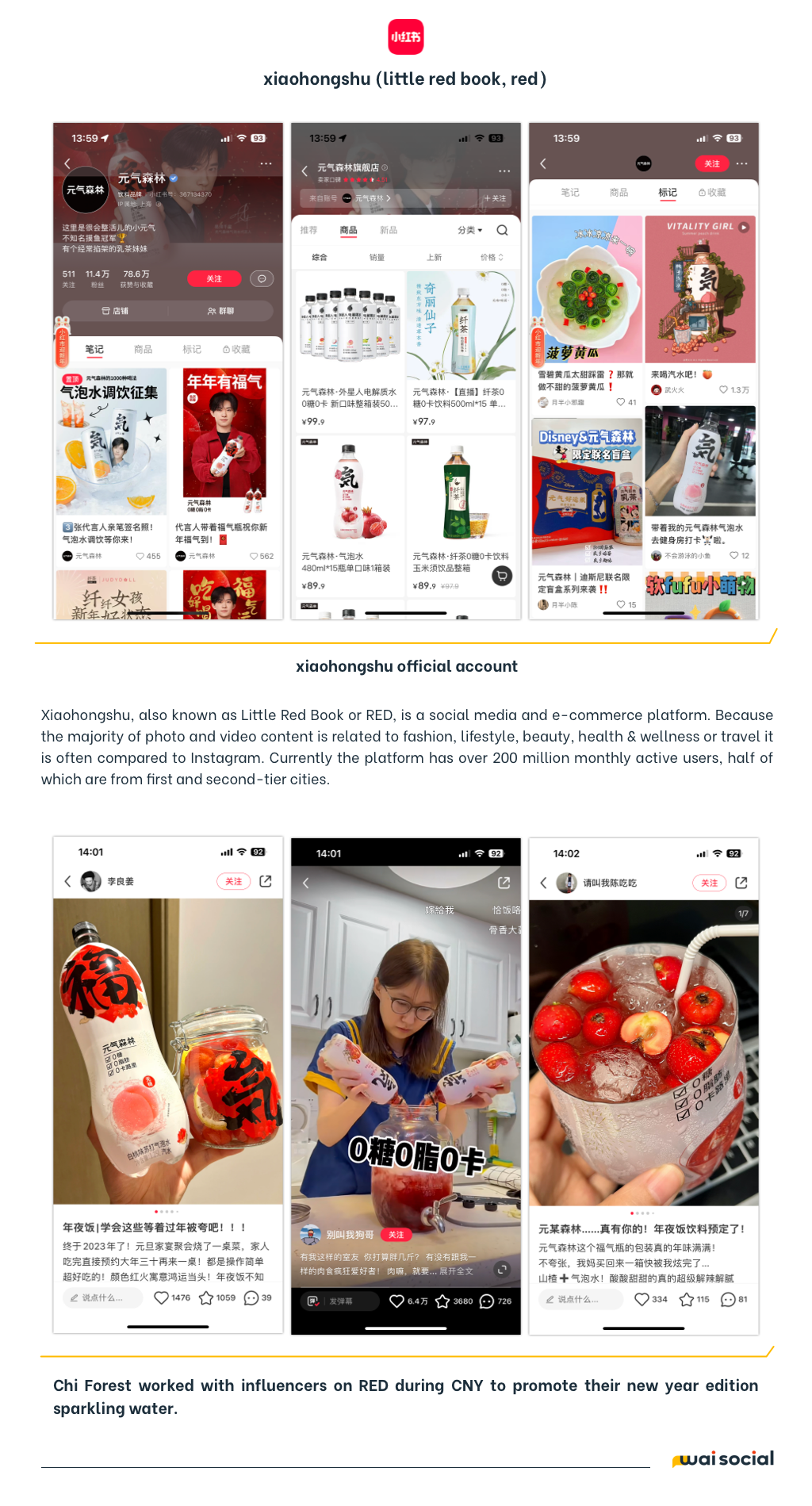

5. Understand the differences between Chinese social media platforms. Chi Forest's Weibo account has achieved the largest growth, with 1.84 million fans, thanks to the great contribution of spokesperson Jackson Yee (易烊千玺) — 22 year-old male celebrity who has 89.72 million fans on the same platform. Chi Forest leverages live-streams on Douyin for sales, dance videos on Bilibili to connect with Gen Z, and good-looking pictures of products on Xiaohongshu to attract millennial female consumers.

CHANNELS

Weibo (1840k followers), WeChat with Channels & store, RED (Xiaohongshu) with store (114k followers), Douyin (696k followers) with separate store account (102k followers), Bilibili (702k followers)